irrevocable trust capital gains tax rate 2020

The 0 and 15 rates continue to. For tax year 2020 the 20 rate applies to.

The Tax Benefits Of Investing In Small Businesses Bny Mellon Wealth Management

For tax year 2020 the 20 rate applies to amounts above 13150.

. Trust tax rates follow similar rates to those paid by individuals but reach those rates at much lower thresholds. The maximum tax rate for long-term capital gains and qualified dividends is 20. 3 What is the tax rate on an irrevocable trust.

For example the top ordinary Federal income tax rate is 37 while the top. The tax rate schedule for estates and trusts in 2020 is as follows. The maximum tax rate for long-term capital gains and qualified dividends is 20.

If you have additional questions or concerns about capital gains. The 2020 estimated tax. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

For example the top federal. Discover Helpful Information and Resources on Taxes From AARP. By comparison a single investor pays 0 on capital gains if their taxable income is.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Capital Gains and an Irrevocable Trust- Having this trust affects who pays any owed capital gains taxes. What is the capital gains tax rate for trusts in 2020.

The trustee of an irrevocable trust has discretion to distribute income including capital gains. For tax year 2020 the 20 rate applies to amounts above 13150. For more information please join us for an upcoming FREE webinar.

Expert asset protection since 1906. Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. Ad Compare Your 2022 Tax Bracket vs.

1 What Is The Capital Gains Tax Rate For Irrevocable Trusts. For tax year 2020 the 20 rate. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits.

The 15 rate applies to. And would have to pay 60000 in federal capital gains tax 15 percent capital gains rate applied to the 400000 gain. All Major Categories Covered.

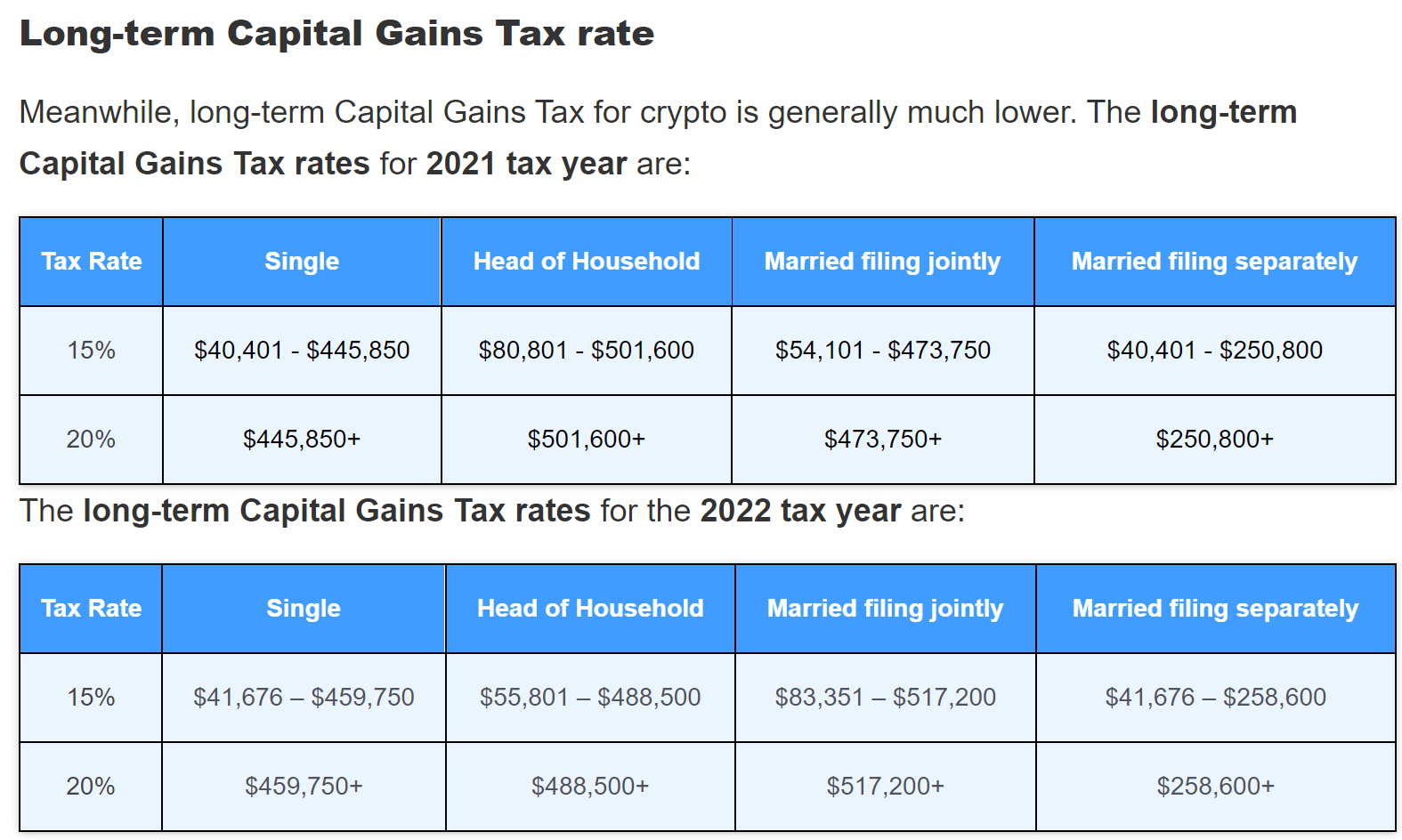

Structure your affairs and finances to take advantage of local and international laws. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

The maximum tax rate for long-term capital gains and qualified dividends is 20. In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income.

Ad Protect your financial privacy. Select Popular Legal Forms Packages of Any Category. You need to weigh pros and cons.

The 0 rate applies up to 2650. If an irrevocable trust distributes or transfers an asset to a beneficiary instead of selling the assets and distributing the gain then the beneficiary becomes responsible for any. Chat With A Trust Will Specialist.

Expert asset protection since 1906. 2022 Long-Term Capital Gains Trust Tax Rates. Ad Protect your financial privacy.

Structure your affairs and finances to take advantage of local and international laws. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35. For tax year 2020 the 20 maximum capital gain rate applies to estates and trusts with income above 13150.

The trustees take the losses away from the gains leaving no chargeable gains for the. In this case the capital gains in a trust are calculated. 2 Do irrevocable trusts pay capital gains taxes.

Trust tax rates are very high as you can see here. Built By Attorneys Customized By You. Here are the rates and thresholds for 2020.

Contact Coral Gables Trust Attorneys. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Your 2021 Tax Bracket to See Whats Been Adjusted.

Thoughts On Virtual Crypto Currency Taxation In The Us Htj Tax

The Fundamentals Of Canadian Estate Tax Dummies

Phys Keep More Of What You Earn

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Tax Strategies Using Nua For Modestly Appreciated Stock

Thoughts On Virtual Crypto Currency Taxation In The Us Htj Tax

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Trust Tax Rates And Exemptions For 2022 Smartasset

Trust Tax Rates And Exemptions For 2022 Smartasset

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Tax Efficient Investing In Gold

What Can The Wealthy Do About Biden S Proposed Tax Increases

What If We Go Back To Old Tax Rates Barber Financial Group

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

Tax Efficient Investing In Gold

The Tax Benefits Of Investing In Small Businesses Bny Mellon Wealth Management